SMM January 21st Report:

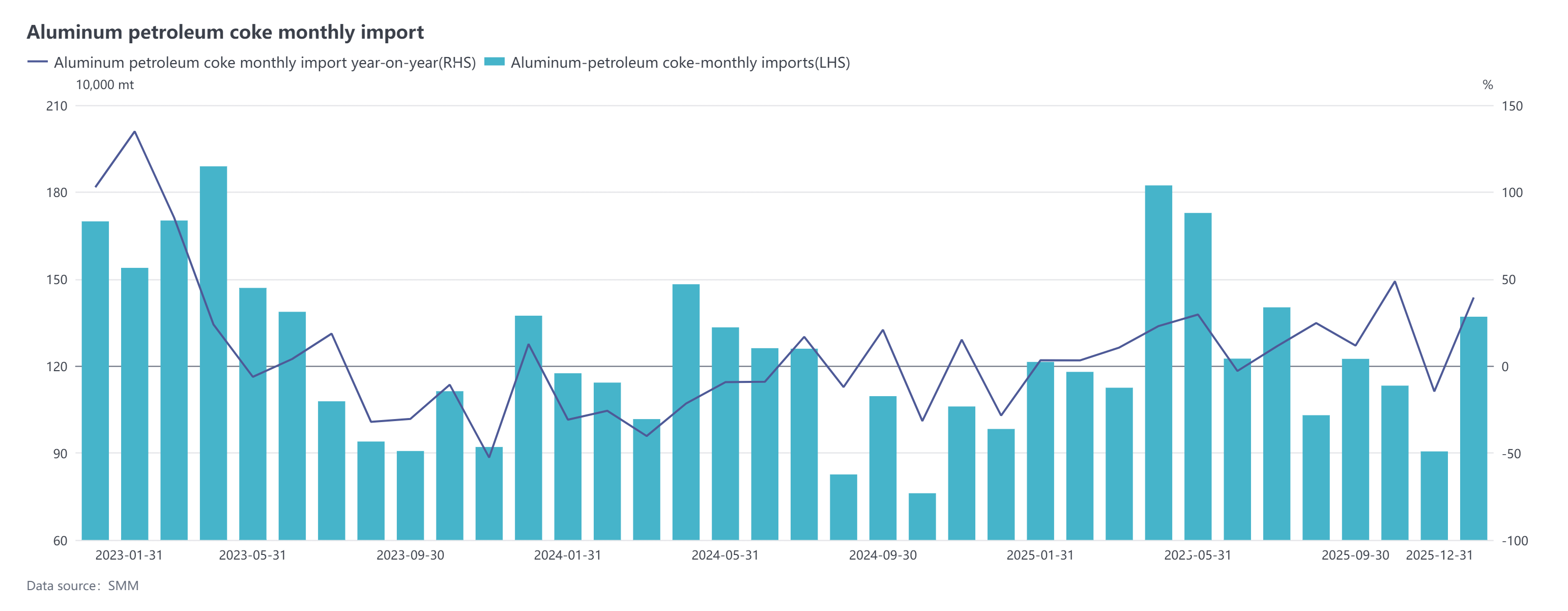

According to customs data, China's petroleum coke imports in December 2025 reached 1.3702 million mt, up 51.32% MoM and 39.41% YoY; the estimated import price for petroleum coke in December was $229.34/mt, down 1.68% MoM but up 67.60% YoY. The total cumulative imports of petroleum coke in China for 2025 were approximately 15.3618 million mt, up 14.65% YoY.

In terms of import sources, the main countries/regions from which China imported petroleum coke in December 2025 were the US, Russia, and Saudi Arabia, with import volumes (import share) of 379,100 mt (28%), 250,500 mt (18%), and 184,600 mt (13%) respectively.

Regarding import price performance, petroleum coke import prices in December 2025 showed a pattern of more increases than decreases. The average import price for the month was $229.34/mt, a slight pull back of 1.68% MoM, but a significant rise of 67.60% YoY, demonstrating strong annual growth momentum. By country, Indonesia, Belgium, and Canada saw the most notable price increases, all above $66/mt, with Indonesian imports showing particularly significant gains, driving the overall upward trend in import prices. Meanwhile, Argentina, the US, and Russia experienced noticeable declines in petroleum coke import prices, but these drops were relatively mild, all within $40/mt, and did not significantly impact the overall "more increases than decreases" pattern.

In December 2025, China's petroleum coke imports showed a wide-ranging increase, becoming a key period for high import volumes and a peak for the year. The core drivers were twofold: on one hand, in November 2025, China and the US clearly stated that a 13% tariff on US petroleum coke would be implemented for one year, eliminating the wait-and-see sentiment and order delays among traders. The cost advantages of importing high-sulphur sponge coke from the US became evident, and previously accumulated orders were released, arriving in large numbers in December, forming the core of the monthly import increase. On the other hand, as the Chinese New Year holiday approached, domestic traders and downstream enterprises initiated early stockpiling plans, further boosting import volumes. At the same time, the surge in imports also led to a concurrent rise in domestic port inventories, with an increase in high-sulphur coke supply, causing prices to experience a slight correction.

Entering Q1 2026, as domestic refineries gradually resume operations after maintenance, the supply side is expected to steadily improve. Coupled with the commissioning of new delayed coking units in 2026, domestic petroleum coke production will increase, squeezing the space for imported coke. Overall, influenced by seasonal fluctuations during the Chinese New Year, the pace of resumption of downstream enterprises, the release of new domestic capacity, and the continuation of Sino-US tariff policies, petroleum coke imports in Q1 are expected to follow a "high in January, pull back in February, rebound in March" pattern, with the total import volume projected to remain at 3.5-3.7 million mt, basically flat compared to the same period last year. In the future, the commissioning progress of new delayed coking units, changes in Sino-US tariff policies, and the resumption of operations in downstream industries will be the core variables determining the actual trend of petroleum coke imports in Q1 and maintaining the supply-demand balance, requiring close and continuous attention.